FAB Balance Check: Step-by-Step Guide for Instant Balance Inquiry | 2025

Want to check your First Abu Dhabi Bank account balance in seconds? We’ve got you covered; you can check your FAB balance on our site. We will provide you with a detailed guide on FAB balance checks and discuss multiple methods to check your First Abu Dhabi bank account balance. Whether you prefer online banking, the FAB Mobile App, SMS services, or ATMs, First Abu Dhabi Bank (FAB) offers multiple hassle-free options to check your balance anytime, anywhere.

Now, you don’t have to visit the branch or wait for your turn in the long queue at the bank; you can check your balance from anywhere in the world without any time restrictions. Let’s dive in and find the best method for you!

What is First Abu Dhabi Bank (FAB)?

First Abu Dhabi Bank (FAB) is known for its customer-centric banking solutions, innovation, security, and financial growth. FAB is the largest bank in the United Arab Emirates; the bank was formed by merging First Gulf Bank (FGB) and National Bank of Abu Dhabi (NBAD) in 2017. The bank’s headquarters is in Abu Dhabi; it successfully expanded its networks globally in multiple countries such as Saudi Arabia, Egypt, Bahrain, Kuwait, Oman, the UK & USA, France, Switzerland, India, Singapore, China, Hong Kong, and Brazil.

FAB offers personal, corporate, investment, and Islamic banking services. The bank serves millions of customers across various continents, making it a leader in the UAE’s financial world and proving it is always ahead of the curve.

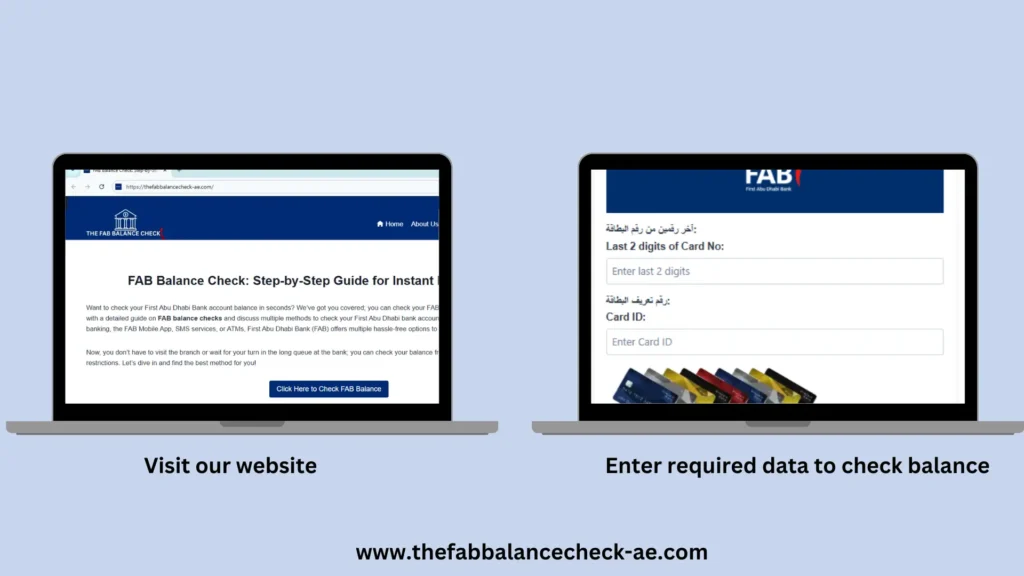

FAB Balance Check | Prepaid Card Balance & Services

You can check your prepaid card balance below by entering required data such as last two digits which you can find on the backside of card and card ID, you can find your 16 digit card id on the frontside of your prepaid card.

Card Services – PrePaid Card Inquiry

How to Check Your FAB Balance?

Multiple methods are available to check your balance at FAB; the bank offers seven convenient methods. You can choose the one that is best for you and check your bank account balance easily and quickly. A list of all FAB balance enquiry methods is given below:

- FAB Mobile Banking App

- FAB Online Banking

- SMS Banking

- ATM Balance Inquiry

- Phone Banking (Customer Support)

- FAB Payit App

- Visit FAB Branch

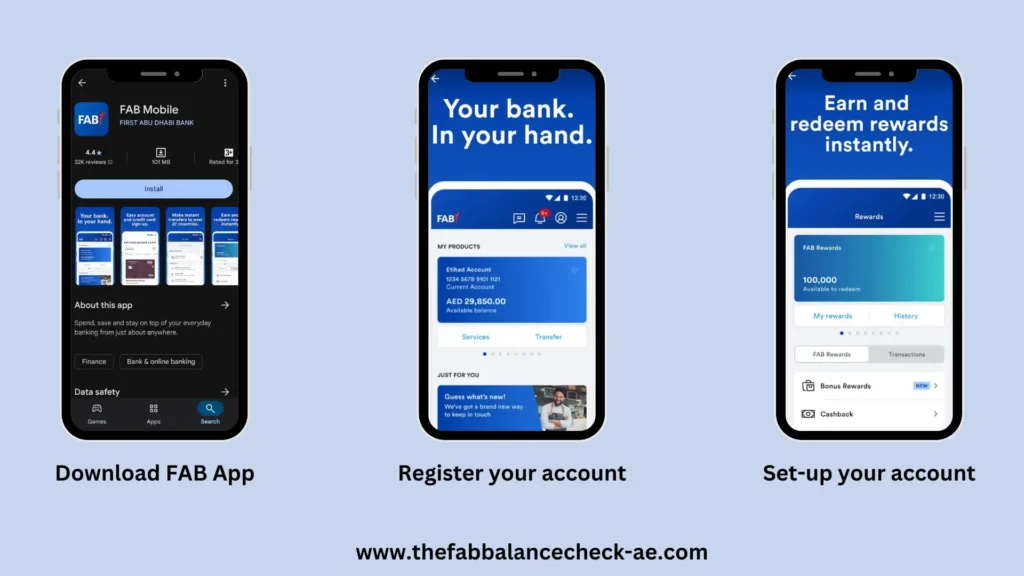

FAB Balance Check By Using Mobile App

Checking First Abu Dhabi Bank’s balance is a piece of cake when using the bank’s official mobile application, which is one of the most secure methods of viewing your account balance. Here’s a step-by-step guide to checking your balance through your mobile phone.

Detailed Steps to Check FAB Balance via Mobile Application

- Download the FAB Mobile Application. It is available on both the Google Play Store and the Apple App Store.

- Open the application and click on the login.

- Put your username and password in it and hit the login button.

- If you’re a new user, register your account on the application or call the helpline.

- After logging in, you can see your balance on the home screen, or you can check your current balance in the app’s account section.

Benefits of Checking Balance Through Mobile Application

- You can quickly access your account anytime and anywhere.

- The app provides a secure and user-friendly interface, making checking and performing transactions on your account easy.

- You can view and download the account transaction history.

Check Your FAB Balance Online

The online banking method is the simplest and most convenient way to check your FAB balance. You can access your account from anywhere in the world and perform transactions. Follow this step-by-step guide to access your account balance through this method.

Detailed Guide to Check Balance through Online Website Method

- Open Chrome or any browser available on your device.

- Search for FAB Online Banking, look for the website with the URL https://bankfab.com/, and click on it.

- When the website loads completely, click on the login button, enter your username and password, and hit the login button.

- Now, you have to verify the ownership of the account. An OTP ( One-Time Passcode) will be sent to your registered phone number or email. Enter the OTP to access your account.

- You can see your balance on your account’s homepage. You can also perform transactions on your account through this online method.

Benefits of Using Online Method

- You can access your account anytime.

- This method is secure and reliable.

- You can view or manage multiple accounts on one device.

- You can access your account from any device.

Check First Abu Dhabi Bank Balance via SMS Banking

SMS banking is a commonly used method to check account balances. This method only works to check account balances, and you can not make any transactions through it. Currently, this method is only available to UAE users. Follow the given steps to check your balance through SMS.

Steps to Check FAB Balance via SMS

- Open the SMS application on your mobile device.

- Compose a new message and type “BAL” with the last four digits of your FAB account number.

- Send the message to 2121.

- You will receive a message with your current account balance from 2121.

Benefits of Using SMS Method

- You can check your bank balance from any mobile phone.

- You don’t require the Internet to check your current account balance.

- You will get an instant balance update from the bank.

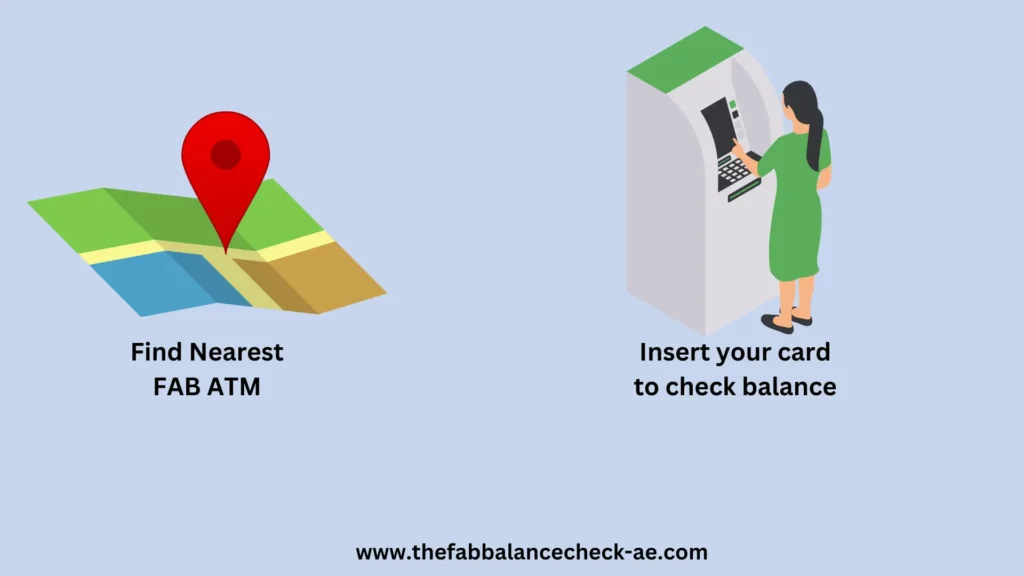

How to Check Your FAB Balance Using an ATM

If you don’t have any device or internet access, you need to view your balance or perform transactions from your account. FAB got you covered. Now, you can view your account balance through FAB bank’s ATM. Follow these simple and quick steps to view your balance using the ATM method.

Steps to View Balance via ATM

- Open Google Maps and search for the nearest FAB ATM.

- Visit your nearest First Abu Dhabi Bank ATM.

- Insert your FAB Credit, Debit, or Prepaid Card.

- Enter your PIN and select the balance inquiry option on the ATM screen.

- Your account balance will be displayed on the screen.

Benefits of Using ATM Method

- You don’t need to have a smartphone or internet.

- You can withdraw cash from your bank account at the same time.

Check Your FAB Balance Through Phone Banking (Call Support)

First Abu Dhabi Bank offers customer service by phone. You can now contact the FAB support team on the official helpline number and inquire about your bank balance by providing your card number or account number.

Steps to FAB Balance Check via Phone Call Banking

- Open the call application on your mobile phone.

- Dial (600 52 5500); this help-line number is only valid for UAE users.

- Follow the IVR (Interactive Voice Response) instructions.

- Hear IVR carefully and select the balance inquiry option.

- You can also talk to a customer service representative for assistance.

Benefits of Using Phone Banking

- You can get help or assistance with any account-related issue.

- You have an option to speak directly to a representative.

FAB Balance Check via Payit Wallet App

Payit is a digital wallet app powered by First Abu Dhabi Bank (FAB). It allows users to send and receive money, conduct cashless transactions, and pay utility bills. The app supports the latest features, like QR code payment. You can also receive remittances from other countries with low fees. Let’s check the simple and quick steps to check the balance on the Payit application.

Guide to Check Balance via Payit App

- Download the Payit Digital Wallet app from the Google Play Store.

- Open the app and log in with your registered details.

- After logging in, click on the account section.

- Your live account balance will be displayed on the mobile screen.

Benefits of Using Payit Application

- The Payit app method makes checking your account balance very easy and fast.

- You don’t need to visit an ATM or bank branch to check your balance.

- This method is very secure and convenient.

Check FAB Balance by Visiting FAB Branch

The most traditional method of checking your account balance is visiting a bank. Many people still use this method today. You can make transactions and withdraw money from your account. Follow these simple steps to check your bank balance by visiting a branch.

Steps to FAB Balance Check at Branch

- Visit your nearest bank branch.

- Get a token and wait for your turn.

- Approach the customer service counter at your turn.

- Provide your bank account number and ID to the teller.

- The teller will give your bank balance information.

Benefits of Using Branch Visiting Method

- You can solve your account issues by visiting the FAB bank branch.

- You can get face-to-face assistance from a bank representative.

What Are the Best and Easiest Ways to Check Your FAB Account Balance?

|

Method |

Best For |

Why It’s Good |

Rating (out of 5) |

Processing Time |

|---|---|---|---|---|

|

Mobile Banking App |

Convenience |

Check balance anytime, anywhere |

★★★★★ |

Instant |

|

Online Banking |

Desktop Users |

Access from any device with internet |

★★★★☆ |

Instant |

|

ATM |

Cash Withdrawals |

Check balance while withdrawing cash |

★★★★☆ |

Instant |

|

SMS Banking |

Quick Balance Inquiry |

Fast and works without internet |

★★★★☆ |

Few Seconds |

|

Customer Service |

Issue Resolution |

Good for account-related issues |

★★★☆☆ |

5-10 Minutes |

|

Bank Branch Visit |

In-Person Service |

Best for detailed account queries |

★★☆☆☆ |

Longer Wait |

How International Users Can Check FAB Balance

Are you from outside the UAE and want to check your account balance? Don’t worry, we have your back! We will provide easy and quick methods to check your FAB account balance, which also works for international users. All methods are given below for checking the balance while remaining outside the country:

- Online FAB Banking

Visit the official website of First Abu Dhabi Bank, click on the login button, and enter your ID number and password. Then click on the view balance button, and your balance will be displayed on the screen. This method is best for international users of FAB bank. - Official FAB Mobile App

Download the official application of FAB Bank and log in with your registered credentials. Click on the account to view your current balance. This method is very simple and quick, and international users can also operate their accounts from outside the UAE. - International Customer Support

FAB Bank offers a separate helpline number for international users. Dial (+971 2 681 1511) and carefully listen to the instructions of the Interactive Voice Response (IVR) to check your account balance or speak to a bank representative. - ATM Inquiry (Partner Banks)

You can check your account balance at any ATM that supports Visa or MasterCard networks. Insert your card into the ATM, enter your 4-digit PIN code, and look for the option “Balance Inquiry.” Some international ATMs charge a small fee to check your balance.

How to Check FAB Prepaid & Ratibi Card Balance?

If you have Prepaid or Retibi cards and are worried about how to check your card balance. We’re here to help and guide you on how to check your FAB card balance. All methods work and are easy to understand; you can use any of them according to your preference. FAB balance check methods are listed below:

- Online Balance Inquiry

- FAB Mobile App

- ATM Balance Check

- SMS Alerts

- Customer Support

Benefits of Checking Your Bank Balance Regularly

Regularly monitoring your account balance is a smart financial habit; you can monitor your daily expenses. The benefits of a checking account balance are countless; some of these benefits are given below:

Avoid Overdrafts & Fees

Checking your account balance regularly helps you plan expenses. It can also avoid overdrafts, bounced checks, and unnecessary penalty fees.

Track Spending & Budgeting

You can make an adequate budget and control your daily expenses. You can also monitor overspending and make better financial decisions. Checking account balances on a daily basis helps you achieve your savings goals.

Detect Fraud & Unauthorized Transactions

By checking your account balance regularly, you can avoid suspicious or fraudulent activities such as unauthorized transactions, baking errors, fraudulent charges, unexpected subscription renewals, unfamiliar ATM withdrawals, and hacked account activity. If you are facing any of these issues, you can contact a bank representative.

Improve Financial Planning

Checking account balances helps you make better financial decisions. By understanding the flow of funds in your bank account, you can make investments and save.

Maintain a Good Credit Score

Paying your bills on time can improve your credit score, which in turn increases your financial reputation. Checking your account balance helps prevent overdrafts and bounced checks.

How to Register for FAB Online Banking?

Visit the FAB Website

- Open the browser on your mobile or computer.

- Search for First Abu Dhabi Bank (FAB) and look for this website URL: www.bankfab.com.

- Click on the accounts button in the top right corner.

- Select “Online Banking Option” from the dropdown menu of the account button.

Click on ‘Register Button’

- After selecting the online banking option.

- Click on the “New to Online Banking Option”.

- Click on the register now button.

Enter Your Details

- The registration page of online banking appears on your screen.

- Enter your account details, such as FAB Debit/Credit Card and account numbers.

- Enter your Card PIN with your registered mobile number and email for verification.

Verify Your Identity

- You will receive an OTP (One-Time Password) from the bank on your registered mobile number and email address.

- Enter the OTP that you received to proceed.

Create Login Credentials

- Create a unique username to log in to your account.

- Create a strong password by following security guidelines.

Complete Registration

- After filling out all required details, review your registration form and submit it.

- Your form will be reviewed by a specific department of FAB bank.

- Once your account is approved, you will receive a confirmation message on your registered mobile number and email address.

Log In & Start Using FAB Online Banking

- Once your account is approved, click the “Login” button on the same website.

- Enter your username and password and hit the login button.

- Now, you can access your bank account through online banking, which allows users to check their balance or perform transactions.

How to Reset FAB Online Banking Password

There are two simple and quick methods available to reset your online banking password. Follow these easy and quick steps to set a new password on your account.

Reset Password Through Official Website

- Visit the official website of FAB Bank.

- Click on the login page and enter your username.

- Look for the forget password button on the screen and click on it.

- Enter your card number or customer ID.

- Verify your identity through a registered mobile number and email address.

- Set a new password and click on unlock my account.

Reset Password Through Phone Call

- Open your call application and dial the help-line number of FAB Bank (600 52 5500).

- Listen to IVR instructions and choose to talk to a bank agent.

- Describe your situation to the bank agent and request help to change your password.

- Verify your account ownership as per agent instruction.

- The agent will guide you and help you set a new password for your account.

How to Use the First Abu Dhabi Banking App?

FAB Bank App is very easy to operate. It has a simple and friendly interface that is very easy to understand. The FAB banking app allows users to check account balances, transfer money, pay utility bills, and access other futuristic options. Read our detailed guide on using the FAB application to get started.

Download and Install the FAB App

- Download the First Abu Dhabi Banking app from the App Store or Google Play Store.

- Open the app on your device.

Log-In With Username & Password

- Select the login option in the app.

- Enter your username or debit/credit card number and password.

- After logging, you can check your FAB account balance and perform transactions.

Features of the FAB Mobile App

- Quick & Secure Login

You can securely login your account by using fingerprint, face ID, passcode, and password. - Account Balance & Transaction History

You can check your FAB Bank account balance and view and download your previous transaction history. - Fund Transfers

The FAB app makes it easy to transfer funds from one account to another. The app allows you to send or receive funds without visiting the bank. - Bill Payments & Mobile Recharge

You can now pay your utility bills from home. The FAB Banking app provides an option to recharge your mobile and pay your bills through the app. - Credit & Debit Card Management

Managing cards is easy with the FAB app. The app allows users to activate, block, or replace cards. You can also set spending limits and enable/disable international transactions. - Prepaid & Ratibi Card Services

You can reload and check the balance of Prepaid & Ratibi cards directly from the FAB app. - Apply for Banking Services

You can apply for banking services from home, such as new account openings, and apply for loans, credit cards, and fixed deposits. - Smart Alerts & Notifications

FAB provides instant notification of transactions, payments, and new offers. - Locate FAB ATMs & Branches

The app has a built-in locator feature that allows you to find nearby FAB Bank branches and ATMs.

FAB App Security Tips

- Use Strong Login Credentials: Set a long password with a combination of uppercase & lowercase alphabets, numbers, and special characters.

- Enable Biometric Authentication: You can use biometric authentication to make your account more secure and easily accessible.

- Avoid Public Wi-Fi: Don’t use public Wi-Fi to log in to your bank account.

- Enable Two-Factor Authentication (2FA): Enable two-factor authentication to add an extra layer of security to your account.

- Keep Your App Updated: Always update your app on time for security updates and bug fixes.

How to Pay FAB Credit Card Bills

There are multiple methods available to pay the FAB Credit Card bill. Using these methods, you can quickly pay your bill before the due date and avoid late fees. All the methods are given below:

Via FAB Mobile App

You can pay your credit card bill using the FAB banking application. The method is simple: log in to your FAB app, select the credit card option from the dashboard, check your credit card bill, enter the amount, and confirm your payment.

Through FAB Online Banking

You can also use FAB Online Banking to pay your utility and credit card bills. Simply open the browser, search for FAB Bank, and look for the official website. Visit the official website and log in with your credentials. After logging in, look for the payments section, click on it, select the credit card, and enter your bill amount to pay.

Using FAB ATMs & Cash Deposit Machines (CDM)

Visit your nearest FAB ATM or CDM machine, insert your debit card, and enter your PIN. Then, select bill payments and choose FAB Credit Card payment. Enter your amount and hit the “PAY” button.

Auto Payment Setup

You can set up Auto Payment Setup through your mobile app or online banking, and your bill will be paid automatically before the due date.

Paying via Exchange Houses

Various exchange houses are available in the UAE, where you can pay your credit card bill using your card number.

FAB Balance Check Errors & Fixes

Incorrect Login Credentials

Solution: Reset your username & password.

Mobile App Not Working

Solution: Update your banking application, restart your device and try again.

Slow Internet Connection

Solution: Change your internet connection or try with mobile data.

ATM Balance Inquiry Issues

Solution: You can try different ATM machines to confirm the problem and contact the FAB help-line.

Account Temporarily Locked

Solution: Reset your password after the temporarily locked period ends.

Online Banking Not Loading

Solution: Use a different browser or you can try after clearing cookies of your browser.

Unregistered Mobile Number

Solution: Register your new mobile number against your account through FAB help-line.

System Downtime or Maintenance

Solution: Wait for the end of maintenance and try again.

Exceeded Transaction Limits

Solution: Call on FAB Bank help-line to increase your transaction limit.

OTP Not Received

Solution: Check your network coverage and try again after changing place.

Pending Transactions

Solution: Wait for the pending transaction to be clear, you can check this by refreshing your screen.

FAB Customer Support Information

FAB vs. UAE Banks: Balance Check Comparison

|

Bank |

Mobile App |

Online Banking |

ATM Check |

SMS Banking |

Phone Banking |

USSD Banking |

|---|---|---|---|---|---|---|

|

FAB |

Yes |

Yes |

Yes |

Yes |

Yes |

No |

|

ENBD |

Yes |

Yes |

Yes |

Yes |

Yes |

No |

|

ADCB |

Yes |

Yes |

Yes |

Yes |

Yes |

No |

|

DIB |

Yes |

Yes |

Yes |

Yes |

Yes |

No |

|

RAKBANK |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Mashreq Bank |

Yes |

Yes |

Yes |

Yes |

Yes |

No |

|

Emirates Islamic |

Yes |

Yes |

Yes |

Yes |

Yes |

No |

|

Commercial Bank of Dubai |

Yes |

Yes |

Yes |

Yes |

Yes |

No |

|

Sharjah Islamic Bank |

Yes |

Yes |

Yes |

Yes |

Yes |

No |

|

Abu Dhabi Islamic Bank (ADIB) |

Yes |

Yes |

Yes |

Yes |

Yes |

No |

Which Bank is Best?

|

Bank |

Best For |

Monthly Fees |

Mobile & Online Banking |

Customer Support |

Loan & Credit Card Options |

ATM Network |

|---|---|---|---|---|---|---|

|

FAB |

Overall Banking |

Low |

Yes |

Excellent |

Wide Range |

Extensive |

|

ENBD |

Digital Banking |

Medium |

Yes |

Good |

Multiple Options |

Large Network |

|

ADCB |

Customer Service |

Low |

Yes |

Excellent |

Good |

Wide Coverage |

|

DIB |

Islamic Banking |

No Fees |

Yes |

Good |

Strong Islamic Finance |

Large Network |

|

RAKBANK |

SME & Business Banking |

Medium |

Yes |

Excellent |

Good |

Moderate |

|

Mashreq Bank |

Premium Banking |

High |

Yes |

Good |

Exclusive Options |

Moderate |

|

Emirates Islamic |

Shariah-Compliant Services |

No Fees |

Yes |

Good |

Islamic Banking Focus |

Large Network |

|

Commercial Bank of Dubai |

Business Banking |

Medium |

Yes |

Decent |

Business Loans & Credit |

Moderate |

|

Sharjah Islamic Bank |

Ethical Banking |

No Fees |

Yes |

Good |

Limited |

Moderate |

|

ADIB |

Shariah-Compliant Services |

No Fees |

Yes |

Excellent |

Great Personal Finance Options |

Large Network |

Based on this analysis First Abu Dhabi Bank (FAB) is the best bank in the UAE.

Why Do You Need A FAB Bank Account In Dubai?

FAB Bank account offers multiple benefits. Whether you’re a resident or a business owner, opening an account in the FAB is a wise financial decision. Here’s why you need one:

- Easy Salary Transfers: Many employees in the UAE prefer FAB Bank for salary transfers because the bank charges very low fees.

- Wide ATM & Branch Network: FAB Bank has a network of ATMs across the country that offer fee-free withdrawals for FAB account holders.

- Exclusive Discounts: FAB Bank offers exclusive deals & discounts for their customers.

- Strong Security & Customer Support: FAB ensures high-level security and 24/7 customer assistance for safe and reliable banking.

How To Open FAB Bank Account Guide 2025

Opening an account in the FAB Bank is a piece of cake, whether you are a UAE resident, an expatriate, or a business owner. FAB Bank offers different types of accounts to meet your financial needs, such as savings, current, and salary accounts.

Eligibility Criteria for FAB Bank Account Opening

The FAB Bank has some requirements to open account, you must meet the following requirements:

- Be at least 18 years old (for personal accounts)

- Have a valid Emirates ID (for UAE residents) or passport with visa (for expatriates)

- Provide proof of income or employment (for salary accounts)

- Minimum deposit requirement (varies by account type)

FAB Bank Account Types for UAE Residents

FAB Bank offer multiple types of accounts for UAE residents

- FAB Current Account

- FAB Savings Account

- FAB Elite Account

- FAB Fixed Deposit Account

- FAB Islamic Banking Account

- FAB Business Account

FAQs-Frequently Asked Question

Conclusion

Keeping an eye on your finances is always a good idea, and with FAB Balance Check, it’s easier than ever. First Abu Dhabi Bank offers multiple methods to check your account balance, such as online banking, the FAB Mobile App, SMS banking, or ATMs. FAB Bank also offers 24/7 customer support if you’re facing any issues regarding your bank account.