FAB Bank Salary Account Balance Check – Easy 2025 Guide

Are you having trouble checking your FAB Bank salary account balance? Don’t be worried. We’ll guide you through the easiest and most reliable method. This guide will cover all updates simply and quickly, going through each step individually. FAB Bank Salary Account offers our customers easy fund transfers, no monthly fees, and a free debit card. It allows users to access and manage their bank accounts via the Internet or mobile apps.

What is a FAB Bank Salary Account?

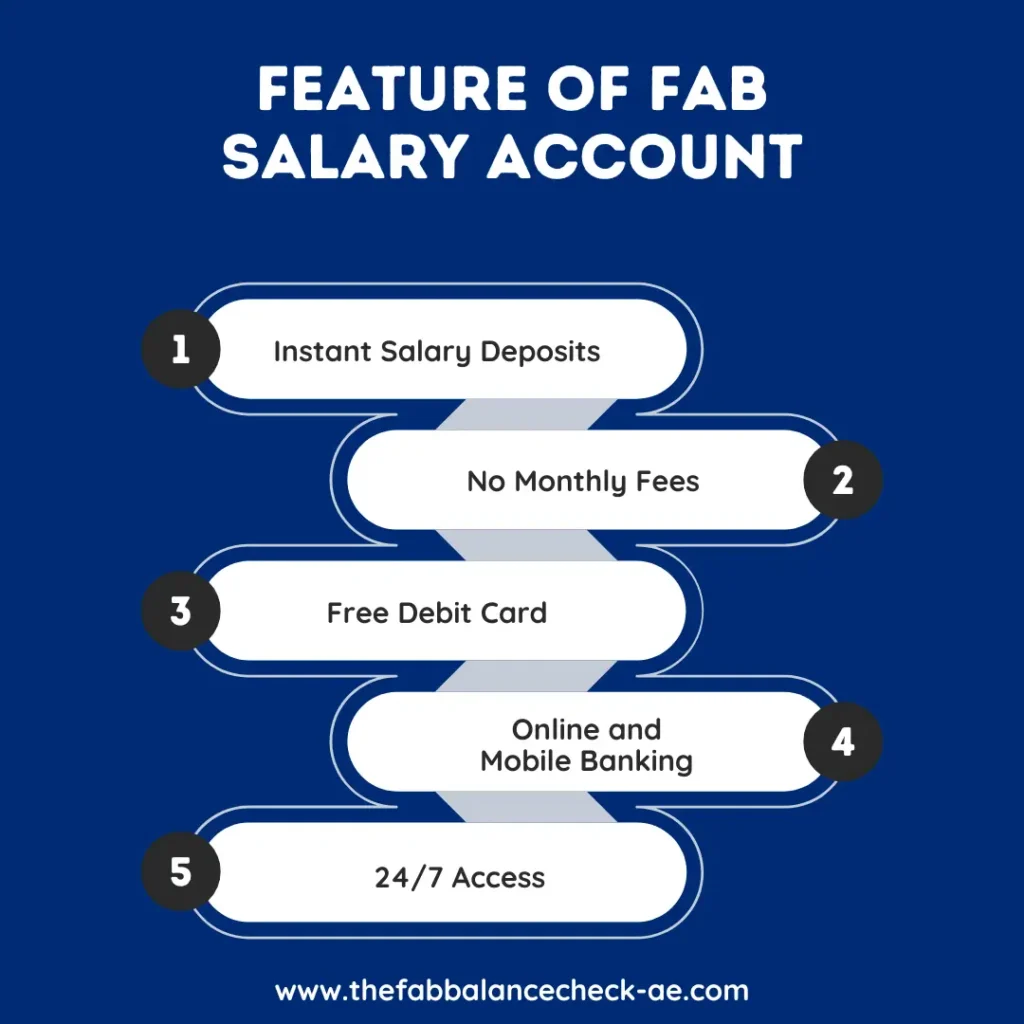

FAB (First Abu Dhabi Bank) salary accounts are created to fulfill the financial needs of employees in the UAE.it is specially designed for salaries. Apart from the main benefit of direct salary deposits, these accounts offer several features to simplify financial management. Account holders can access a variety of easy services, such as:

Instant Salary Deposits

It refers to the immediate transfer of an employee’s salary into their bank account, which takes a few hours.

No Monthly Fees

The customers can enjoy the service without having to pay a regular fee.

Free Debit Card

A “free debit card” means a debit card given to users without any issuance or yearly fees. Customers can use it for transactions, ATM withdrawals, and shopping without incurring extra costs.

Online and Mobile Banking

Online and mobile banking refers to digital platforms that enable users to access and manage their bank accounts through the Internet or mobile apps.

No Minimum Balance Requirement

It is not necessary to maintain a minimum balance in your bank account. If the balance is zero, there will be no penalty or fee for not meeting the required minimum.

Easy Fund Transfers

It can be done easily and quickly via online banking, mobile apps, or payment services without having to go to a bank branch.

24/7 Access

It refers to the ability to use a service or facility at any time, 24 hours a day, 7 days a week, without any restrictions.

Check also: FAB iSave Account

Easy Methods to Check FAB Bank Salary Account Balance in 2025

Here, we will share easy methods to check the FAB bank salary account balance.

1. FAB Mobile Banking App (Quickest Method)

- Step 1: Install the FAB Mobile App from the Apple App Store or Google Play Store.

- Step 2: When it is installed, log in with your username and password or utilize biometric login (fingerprint or face recognition).

- Step 3: Your salary account balance will appear instantly on the app’s home screen.

2. FAB Online Banking (Website Method)

- Step 01: Go to the official website of FAB Bank at www.bankfab.com.

- Step 02:Locate and click on the online banking login page.

- Step 03: Provide your username and password to log in.

- Step 04:Once logged in, select your salary account to check the balance and recent transactions.

3. FAB SMS Banking (No Internet Required)

- Step 01: First, make sure your mobile number is registered with FAB Bank.

- Step 02:Then, send an SMS with the word ‘BAL’ to 2121 using your registered mobile number.

- Step: 03:You’ll instantly receive an SMS showing your current salary account balance.

4. FAB ATM (Accessible Anywhere)

- Step01: Start by inserting your FAB Bank debit card into any FAB ATM.

- Step 02:Enter your PIN to access your account.

- Step 03:Select the “Balance Inquiry” option on the screen.

- Step 04:Your salary account balance will be shown on the screen.

5. FAB Customer Care (Personal Assistance)

- First, dial FAB customer service at 600 52 5500.

- Follow the prompts from the automated system or talk to a customer support agent for assistance.

6. FAB Email Banking (Online Request)

- Step 1: For banking inquiries, email FAB Bank’s official address (usually available on their website).

- Step 2: In the subject line, mention “Salary Account Balance Inquiry.”

- Step 3: In the email body, include your customer details like account number, name, and any required verification info.

- Step 4: Wait for a response from the bank, which typically includes your salary account balance along with any necessary details.

Note: This method may take longer than others, as it requires manual processing by bank staff.

Read also: Check Du Balance

Additional Features and Services

FAB Payit Wallet

FAB Payit Wallet gives you the option to access and transfer your salary instantly. With Payit, you can make payments, send money, and easily manage your finances from your smartphone. It provides a secure way to track your expenses and set financial goals while supporting various payment methods that make your transactions even more straightforward.

Salary Advance Feature

Eligible customers could gain Access to a salary advance feature, enabling them to withdraw part of their forthcoming salary in advance. This can be beneficial for unexpected costs or emergencies. The feature ensures quick fund access without requiring a loan application or credit check. It helps users manage cash flow and avoid late fees or fines, offering financial flexibility when needed the most.

FAB Contactless Payments

FAB Bank Salary Account Balance provides contactless payment methods, enabling you to make secure and instant purchases by simply tapping your card or smartphone. Whether you’re shopping online or in a store, you can enjoy a quick and convenient payment experience without the need for a PIN or card swipe.

Troubleshooting Common Issues

Issue

Unable to log into the FAB Mobile App.

Solution

Verify that you’re entering the correct login credentials. If you’ve forgotten your password, use the “Forgot Password” option to reset it.

Issue

Not receiving SMS balance updates.

Solution

Make sure your mobile number is registered with FAB and that your telecom provider is not blocking messages from 2121.

Issue

FAB ATM is not dispensing balance information.

Solution

Try using a different FAB ATM, or get in touch with customer service for assistance.

Issue

Cannot make a payment via the FAB Mobile App.

Solution

Check that your internet connection is working properly and that the payment information is entered correctly. If the issue continues, restart the app or contact customer support for help.

Enabling Balance Alerts and Notifications

To monitor your account activity, you can activate balance alerts and notifications via the FAB Mobile App.

- Step 1: Open the FAB Mobile App and log in.

- Step 2: Go to “Settings” and then select “Notifications.”

- Step 3: Turn on balance alerts and adjust your notification settings.

FAB Bank Salary Account Eligibility and Requirements

To open a salary account with FAB, you need to meet some eligibility criteria, such as being employed by a company that has a salary transfer agreement with the bank. Usually, these accounts require minimal documentation, like proof of employment and identification. After opening the account, you can benefit from services like free debit cards, direct salary deposits, and Access to mobile and online banking. Verify the eligibility criteria with your employer or FAB to ensure you qualify for a salary account.

FAQs-Frequently Asked Question

Conclusion

We have had an in-depth discussion about the FAB Bank Salary Account Balance. This account assists employees in fulfilling their financial needs in the UAE. We explain how to use it quickly and cover its various features. We also provide guidance on the correct way to use it. It is a beneficial account for employees. If you encounter any problems with the card or the app, please get in touch with the helpline — don’t hesitate to reach out, as they’re just a call away.