Best FAB Credit Cards 2025 – Cashback, Travel & Rewards

Do you want a cashback or unlock travel benefits and special discounts in different buy categories? Then use FAB Credit Card. Fab Cashback Credit Card rewards you with 5% cashback every time you spend on food, groceries, or retail.

FAB Share Credit Card users earn up to 7% back at Carrefour, VOX Cinemas, and Ski Dubai. You’ll also benefit from flexible 0% payment plans, exciting lifestyle discounts, and seamless digital banking through the FAB app. Get started now!

Travel in style with the FAB World Elite Credit Card—enjoy lounge access, free airport rides, and complete travel insurance coverage. Such incredible rewards are perfect for every employee. Apply for your FAB credit card in UAE without delay!

What is a FAB Credit Card?

FAB credit card is a debit card introduced by First Abu Dhabi Bank (FAB), one of the largest banks in the UAE. These cards provide various benefits tailored to different lifestyles and spending habits. They provide 5% cashback and rewards for groceries, dining, and fashion. Fab provides many discounts on travel, lifestyle, digital banking, etc. FAB provides a wide selection of credit cards, such as the Cashback Credit Card, Elite Credit Card, and co-branded options like the Etihad Guest Credit Card—each tailored to match your unique lifestyle and spending needs.

Check also: Ratibi Card Salary Check

FAB Credit Card Types

Here, we describe various credit cards.

1. FAB Cashback Credit Card

Benefits: 5% cashback on groceries, food and shopping.

Ideal for: Those who spend every day and enjoy saving with cashback.

2. FAB World Elite Credit Card

Benefits: Honor Airport Lounge Access, free airport transfer, and travel insurance.

Ideal for: Constant travelers in search of luxurious quotas.

3. FAB Platinum Credit Card

Benefits: Lifestyle discounts, food supply, and security security.

Ideal for: Individuals who want a premium card with everyday benefits.

4. FAB Etihad Guest Credit Card (Co-Branded)

Benefits: Etihad Guest Miles, free upgrades, prioritized check-in.

Ideal for: Etihad continuous flying and travel lovers.

5. FAB Share Credit Card (Co-Brand)

Benefits: Get up to 7% points in Carrefour, Vox Cinema, and Ski Dubai.

Ideal for: Shop owners and entertainment seekers.

6. FAB Anant Credit Card

Benefits: At the same time, services, exclusive travel agreements, and global acceptance.

Ideal for: People with high network value want elite privileges.

7. FAB Titanium Credit Card

Benefits: Exemption from food, shopping, and entertainment, as well as easy installment scheme.

Ideal for: Budget-conscious users looking for flexibility and value.

8. FAB Manchester City Credit Card (Co-Branded)

Benefits: Exclusive Man City items, match ticket discounts, and club experiences.

Ideal for: Football fan in UAE and supporters of Manchester City.

9. FAB Islamic Credit Card

Benefits: Sharia influenza, cashback, travel allowances, and lifestyle services.

Ideal for: Customers looking for moral banking based on Islamic principles.

Read also: How to Check Du Balance

Best FAB Credit Cards in UAE (2025)

1. FAB Cashback -Credit Card

- Wage Requirements: AED 5000

- Annual fee: AED 300

Top Benefits

- 5% cash back on groceries, food and fashion.

- 3% to international expenses.

- 1% on all other purchases.

- Recruited cinema ticket.

2. FAB World Elite Credit Card

- Wage Requirements: AED 50,000

- Annual fee: AED 1,500

Read also: FAB ATM Near Me

Top Benefits

- Honest access to the airport lounge

- Free airport transfer

- Global Travel Insurance

- Valet -parking and luxurious permits

3. FAB Ratna Titanium Card

- Wage Requirements: AED 8000

- Annual fee: AED 315 (first year free)

Top Benefits

- 4.25% Ratna Education School Fee Payment Cashback

- 0% installment plan for tuition fees

- Ideal for parents

4. FAB Etihad Guest Anant Credit Card

- Wage Requirements: AED 30,000

- Annual fee: AED 2,500

Top Benefits

- 55,000 Etihad Welcome Miles

- 7.5 Etihad Guest Miles Per AED 10

- Honor Lounge Access Worldwide

5. FAB Del Credit Card (Standard, Platinum, Signature)

- Wage requirements: AED 5,000 – 30,000

- Annual fee: AED 315 – 1,050

Top Benefits

- Up to 7% Cashback on CarreFour

- Vox Cinema and Ski Discount in Dubai

- Share on each purchase

6. FAB Manchester City FC Card

- Wage Requirements: AED 5000

- Annual fee: AED 315

Top Benefits

- Special access to Manchester City events

- Matchday Experience and Stadium Tours

- Great for football fans

7. FAB Blue FAB Anant Card of Al-Fatima

- Wage Requirements: AED 40,000

- Annual fee: free

Top Benefits

- 5% cashback in al-fatt hour marks

- Travel surplus and lifestyle discounts

- Loyal al-Futtaim is great for shop owners

8. FAB Platinum Credit Card

- Wage Requirements: AED 8000

- Annual fee: AED 500

Top Benefits

- Up to 2 FAB Rewards per AED

- Free access to airport salon

- Balance transfer and 0% Easy Payment Plans

Check also: How to Check Etisalat Balance

FAB Credit Cards 2025: Types, Salary Requirements & Fees

Explore the wide range of First Abu Dhabi Bank (FAB) credit cards, each with precise minimum salary requirements and annual fees tailored to your financial lifestyle.

|

Credit Card |

Minimum Monthly Salary |

Annual Fee |

|---|---|---|

|

FAB Cashback Credit Card |

AED 5,000 |

AED 300 |

|

FAB Elite Credit Card |

AED 50,000 |

AED 1,200 |

|

FAB SHARE Standard Credit Card |

AED 5,000 |

Free |

|

FAB SHARE Platinum Credit Card |

AED 10,000 |

AED 1,000 |

|

FAB SHARE Signature Credit Card |

AED 30,000 |

AED 1,500 |

|

FAB GEMS Titanium Mastercard Credit Card |

AED 8,000 |

AED 315 |

|

Etihad Guest Infinite Credit Card |

AED 30,000 |

AED 2,500 |

|

Etihad Guest Signature Credit Card |

AED 15,000 |

AED 1,500 |

|

Etihad Guest Platinum Credit Card |

AED 8,000 |

AED 500 |

|

FAB Low-Rate Credit Card |

AED 10,000 |

AED 300 |

|

du Titanium Credit Card |

AED 5,000 |

Free |

|

Manchester City Titanium Credit Card |

AED 5,000 |

Free |

|

BLUE FAB Infinite Credit Card by Al-Futtaim |

AED 40,000 |

Free |

|

BLUE FAB Signature Credit Card by Al-Futtaim |

AED 15,000 |

Free |

|

BLUE FAB Platinum Credit Card by Al-Futtaim |

AED 8,000 |

Free |

|

FAB Platinum Lifestyle Credit Card |

AED 12,000 |

AED 500 |

Sometimes, the annual fee might be waived for the first year or if certain conditions are met.

Eligibility Criteria for FAB Bank Credit Card

Age Claim: The applicant must be at least 21 years old.

Minimum Monthly Salary: The required monthly income varies depending on the card:

- FAB Cashback Credit Card: AED 5000

- FAB Share Standard Credit Card: AED 5000

- Fab Share Platinum Credit Card: AED 10,000

- FAB Share Signature Credit Card: AED 30,000

- Fab Etihad Guest Anant Credit Card: AED 30,000

- FAB Etihad Guest Signature Credit Card: AED 15,000

- Fab Etihad Guest Platinum Credit Card: AED 8000

- FAB Low-Per Credit Card: AED 10,000

- You Titanium Credit Card: AED 5000

- Manchester City Titanium Credit Card: AED 5000

- Blue Fab Anant Credit Card of Al-Futime: AED 40,000

- Blue Fab Signature Credit Card By Alfuttime: AED 15,000

- Blue Fab Platinum Credit Card of Al-Futime: AED 8,000

- FAB Platinum Lifestyle Credit Card: AED 12,000

Nationality: The applicant should be either:

- UAE Nationals

- UAE Residents

Employment Status: Applicants should be:

- Salaried Employees

- Self-Employed Individuals

Credit Score: A strong credit score is required.

Read also: FAB Securities Login

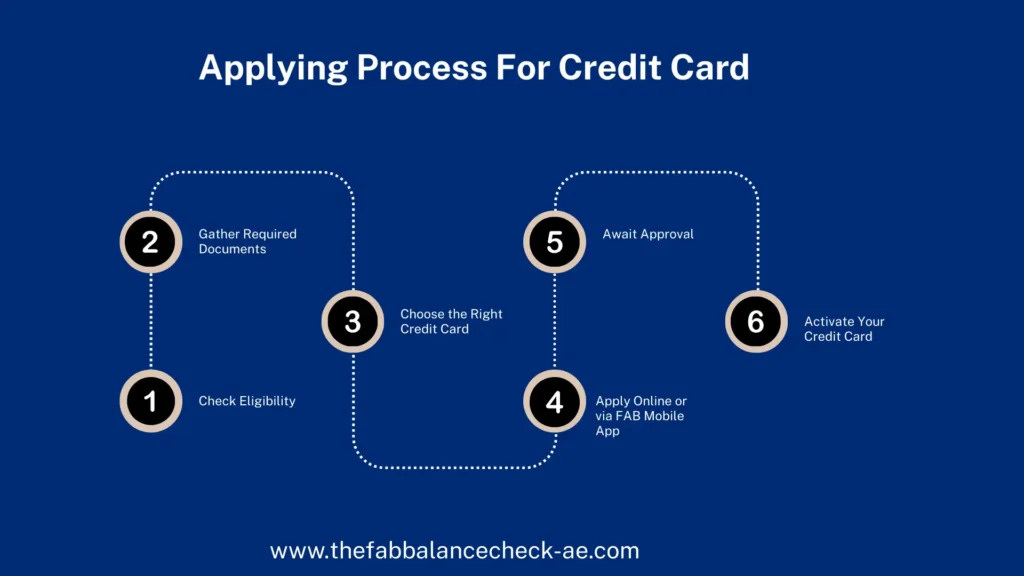

How Do You Apply for an FAB Credit Card?

Choose the Correct Credit Card

Research Available Credit Card: Select a credit card that meets your requirements. FAB offers a variety of cards, such as Cashback, Etihad guests, and elite credit cards. Review the benefits and annual fees.

Consider Selectability

Make sure you meet the selection requirements for the card you want to use, such as minimum wage and age criteria.

Collect the Required Documents

- Valid Emirates ID (for UAE citizens).

- Valid passports and residence waters (for emigrants).

- Salary certificate or wage transfer letter from your employer.

- Bank assignment (usually from the last 3-6 months).

- Tool bill for address verification.

- Business license (for self-employed).

Search Online

- FAB Website: Visit the official FAB website and select the credit card you want to search for. You can fill out an online application form and submit your required documents.

- Mobile app: You can also use the FAB Mobile App to apply for credit cards. Just log in, select the credit card you like, and follow the steps to submit your application.

- Third-party platform: Some websites offer credit card application services to multiple banks, including FABS. Make sure you are using an iconic website.

Visiting Bank

You can go to any FAB branch and search for the person by filling out an application form. Bring all the necessary documents.

Wait for Approval

Once your application is submitted, FAB will review your documents and confirm your qualifications. It may take a few days, based on banking processes. If you meet the eligibility criteria, you will receive an approval notice.

Get your Card

After approval, your FAB Credit Card will be sent to your registered address. You may need to activate the card.

Read also: How to Open FAB Bank Account

Managing Your FAB Credit Card

- Activate Your Card – Use the FAB Mobile App, website, or call customer service to activate your new card.

- Track Spending – Monitor your expenses and set limits using the FAB Mobile App.

- Pay Bills on Time – Set up auto-debit or reminders to avoid late fees.

- Check Monthly Statements – Review your transactions and rewards regularly.

- Update Personal Info – Update your contact details through the app or branch.

- Report Lost Cards – Immediately block and replace lost/stolen cards via the app or helpline

- Use Offers & Rewards – Redeem cashback and enjoy discounts through FAB promotions.

FAB Credit Card Fees

Each FAB credit card has its fee structure. Here are the standard fees

- Annual Fee AED 0 – AED 1,500 (depends on card type)

- Late Payment Fee AED 241.50

- Cash Advance Fee 3.15% (Minimum AED 105)

- Foreign Currency Exchange Fee 2.49%

- Interest Rate Up to 3.50% per month

Best Benefits of FAB Credit Cards

- Cashback Rewards – Get up to 5% cashback on groceries, dining, fashion, and more.

- Airport Lounge Access – Enjoy complimentary access to premium airport lounges globally.

- Travel Perks – Benefit from complimentary airport transfers, travel insurance, and valet parking.

- Easy Payment Plans – 0% installment for school fees, electronics, and travel bookings.

- Exclusive Discounts – Save on movie tickets, dining, shopping, and entertainment (e.g., VOX Cinemas, Carrefour).

- Etihad Guest Miles – Earn bonus miles and travel rewards with co-branded Etihad Guest cards.

- Secure Mobile Banking – Easily manage your card and spending via the FAB Mobile App.

- No Annual Fee Options – Select cards have no annual or waived first-year fees.

FAQs-Frequently Asked Question

Conclusion

This guide explains the different types of FAB credit cards and highlights their rewards and discounts. FAB provides a 5% cashback every time you spend on food, groceries, or retail, offering great value with each purchase. Additionally, FAB offers fantastic deals on travel, bills, and more. We’ll discuss various credit card types, including the Cashback Card, Shopping & Lifestyle Cards, and the FAB Elite Credit Card. You’ll also learn how to use these cards effectively and how to apply for them. Some of these cards can be used in the UAE and internationally, providing fantastic offers wherever you go. It’s truly a case of getting more bang for your buck with FAB.