Ratibi Card Salary Check: Easy Balance Inquiry & Benefits

Do you know about Ratibi Card Salary Check, or would you like to learn more about it? You’re not the only one; many customers are curious about its benefits. Using it is so easy, more than you could have ever imagined. FAB’s Ratibi Card isn’t just for receiving your salary—it offers instant wage access, free SMS notifications, and the option for salary advances.

You were guided on how to check your Balance online, withdraw cash from ATMs, and use the Payit app for digital payments. Let’s explore all the features and benefits the Ratibi Card offers.

What is the Ratibi Card?

The Ratibi Card is a salary payment solution aligned with the Wages Protection System (WPS). It enables employers to pay salaries digitally without employees needing a bank account. The Ratibi Card is only available to employees earning AED 5,000 or less monthly. It follows the UAE’s Wages Protection System (WPS) and offers a secure way to receive salaries without needing a traditional bank account. The Ratibi Card is a prepaid salary card offered by First Abu Dhabi Bank (FAB), designed specially for salary payments.

Who Can Get a Ratibi Card?

- Employees who earn 5000 or less AEDs per month.

- Workers who do not have a personal bank account.

- Employees in companies registered with FABS for wage services.

- Perfect for homemakers, industrial workers, and workers.

- A valid UAE ID is necessary.

Check also: How to Check Du Balance

Ratibi Card Vs Bank Account

|

Feature |

Ratibi Card |

Traditional Bank Account |

|

Account Requirement |

No bank account is needed |

A bank account is required |

|

Salary Payment |

Preloaded onto the card |

Deposited into an account |

|

ATM Withdrawals |

Yes |

Yes |

|

Online Banking |

Limited |

Full access |

|

Transaction History |

Limited |

Full records available |

|

Minimum Balance |

No minimum balance required |

Often requires a minimum balance |

|

SMS Alerts |

Free salary deposit SMS alerts |

Depends on the bank and account type |

|

Salary Advance |

Available through the Ratibi card program |

Depends on bank policies |

Ratibi Card Salary Check – In UAE

Checking your salary through the Ratibi card is extremely easy. In the UAE, this is a simple payment method where employees can access their salary online using the Ratibi card, even without a bank account. With smooth payroll handling, employees can access their wages securely and without hassle. This prepaid card allows users to withdraw cash, shop, and check their salary anytime—making it a simple solution for managing money without a bank account. It’s super easy for anyone to use.

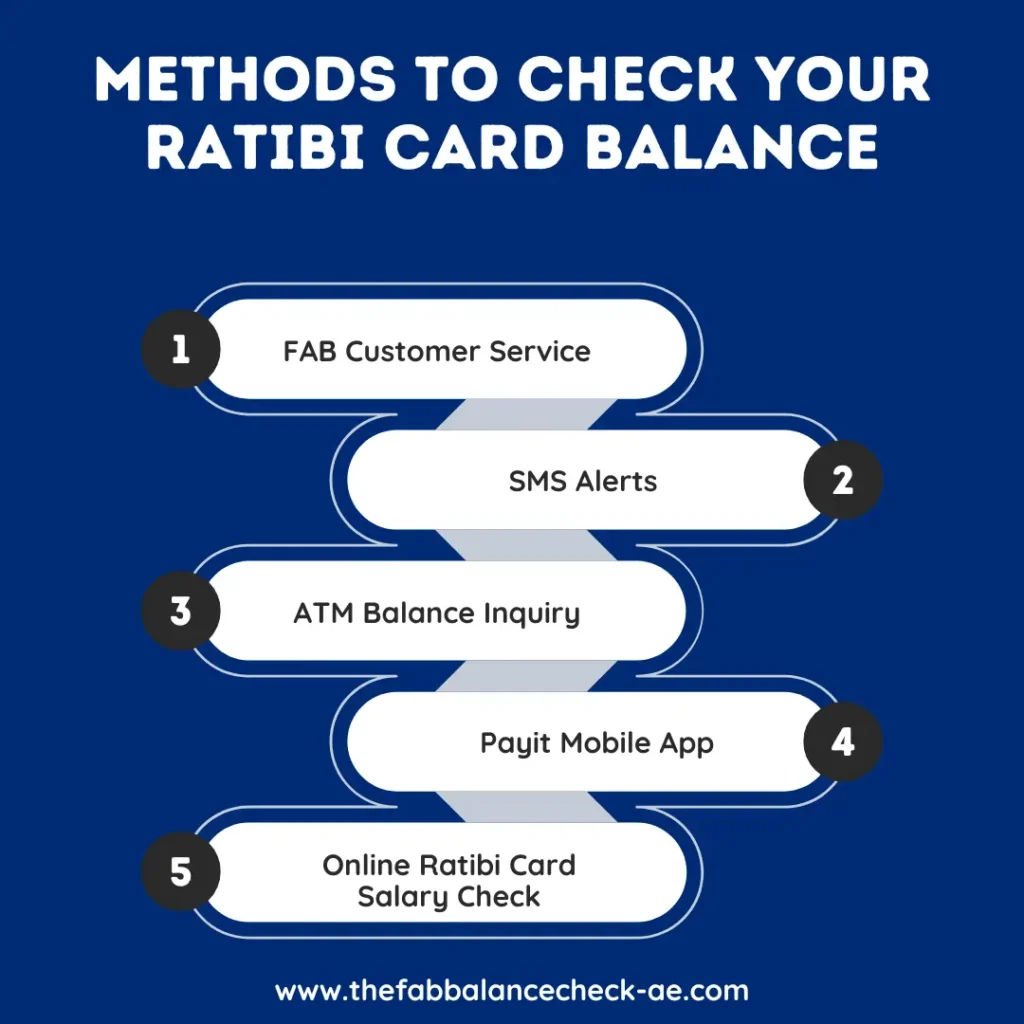

Methods to Check Your Ratibi Card Balance

Online Ratibi Card Salary Check

Step 1: Visit the official Ratibi Prepaid Card Balance Check.

Step 2: Enter the Ratibi card and short ID numbers in the given field.

Step 3: Click the “Check Balance” button.

Step 4: Your current Balance appears immediately on the screen.

Ratibi Card Salary Check Through Payit App

Step 1: Install the Painit app from the Google Play Store or Apple App Store.

Step 2: Start the app and select the “ratibi card holder” option.

Step 3: Scan Emirates -ID -your one to confirm your profile.

Step 4: Enter the Ratibi card details, including the short -ID and the last two digits of your card.

Step 5: Enter your mobile number and confirm it by entering the 6-lead code received via SMS.

Step 6: Enter your 4-lead Security PIN.

Step 7: Your registration is complete, and you can use all the app’s features.

Rabiti ATM Balance Inquiry

Step 1: Find the nearest FAB mining.

Step 2: Enter your Ratibi card in the ATM track.

Step 3: Enter your 4-lead stick.

Step 4: Select “Balance Survey” from the screen options.

Step 5: Your available Balance appears on the screen.

SMS Alerts

Step 1: Make sure your mobile number is registered with your FAB for your Ratibi card.

Step 2: FAB will automatically send SMS notices when a transaction occurs, such as payroll or withdrawal.

Step 3: Each SMS contains essential details such as your transaction amount and Balance.

Step 4: These alerts allow you to monitor real-time Balance without manually examining it.

Step 5: Enjoy security in knowing your finances – simple, sharp, and practical.

Check Your Ratibi Balance via FAB Customer Service

Step 1: If you need personal help, you can reach FAB customer service.

Step 2: Call the official FAB hotline or visit your nearest FAB branch.

Step 3: Give a Ratibi card description to the customer service representative.

Step 4: Request a balance control or other explanation requirements.

Step 5: The representative helps you immediately with accurate balance information and guidance.

Read also: How to Check Etisalat Balance

How to Apply for a Ratibi Card: Step-by-Step Guide

The Ratibi card is specially designed for employees who earn 5000 or less per month. It allows them to easily use their wages without the need for a bank account. We will guide you properly through the application process for a ritual card.

Employer Benefits

- Simplified wage distribution.

- Provide complete compliance with WPS.

- Cash reduces the risk and cost of handling.

- Saves time on wage treatment.

- Increases efficiency and openness.

Employee Benefits

- Pay without requirements from a bank account.

- Remove cash or trade with Ratibi cards.

- Enjoy free accident insurance for security.

- Get SMS information for each transaction.

Check also: FAB iSave Account

Application Form for Ratibi Card PDF

How Does the Ratibi Card Work?

Fabs Ratibi Card AED is a prepaid pay card for workers earning 5000 or less. This removes the requirement for a traditional bank account, so employers can directly transfer salaries to the card. Users can withdraw money from ATMs, shops, and easily check their Balance. The card comes with free SMS information and accident insurance, offering safety and ease of use.

Key Features of Ratibi Card

- No Bank Account Needed: Employees can receive their salaries directly on the Ratibi Card without maintaining a bank account.

- Global Acceptance: The card is accepted worldwide at ATMs, in-store, and online, wherever Visa or Mastercard is supported.

- Free SMS Alerts: Cardholders receive free SMS notifications for every salary credit and transaction

- 24/7 Customer Support: FAB provides round-the-clock customer service to assist with card-related inquiries.

- Personal Accident Insurance: The card includes free personal accident insurance, offering coverage in case of death or permanent total disability due to an accident, hospitalization benefits, and repatriation of mortal remains.

- Access to Salary: Easily withdraw your money from ATMs or use the card to shop in-store and online.

- Pay Bills: Use the Payit app to settle bills for services like DEWA, Etisalat, and DU.

Check also: Best FAB Credit Cards 2025

Additional Benefits of the Ratibi Card

Most employees use the Ratibi Card Salary Check feature to view or withdraw their salary, but it also offers several hidden benefits we’ll explore here.

- Free SMS Alerts: You’ll get an SMS alert every time you withdraw your salary.

- No Bank Account Required: You get access to complete banking services without needing a traditional bank account.

- No Minimum Balance Requirement: All traditional bank accounts need a minimum balance, but the Ratibi Card works without one.

- Global ATM Access: Withdraw cash from ATMs anywhere in the UAE and abroad.

- 24/7 Fund Accessibility: Access your salary anytime and anywhere through ATMs or POS machines.

- Personal Accident Insurance: Get up to AED 25,000 personal accident insurance, AED 50/day for hospitalization (max 30 days), AED 5,000 for transport of remains, AED 25,000 for permanent disability, and AED 2,500 for medical expenses.

Read also: FAB Securities Login

Security Features & Troubleshooting

PIN Protection

PIN protection is secured with an individual 4-lead PIN that must be registered for ATM transactions.

Encrypted Transactions

All data is encrypted to protect your personal and financial information.

SMS Alert

Get instant SMS information for each transaction, which helps you monitor your account in real-time.

Card Deactivation

In case of theft or loss, the card can be blocked immediately by contacting FAB customer service.

Chip and Pin Technology

Advanced Chip Technology adds an extra layer of protection compared to the traditional magnetic stripe card.

Check also: How to Open FAB Bank Account

Hidden Features You Might Not Know

Salary Advances

You can reach 50% of your salary in advance using the Pairit app; when you need cash before payday, you can help.

International Money Transfer

You can send money instantly to more than 200 countries directly with your ritual card, making global transactions easier and faster.

Utility Bill Payments

Pay your usage bills, where Deva, Etisalat, you, and more save time and effort from your card.

Free Personal Accident Insurance

Ratibi card holders receive AED 25,000 insurance in the event of accidental death and further coverage for hospitalization.

Common Issues & Troubleshooting

|

Issue |

Solution |

|

Salary not credited? |

Reach out to your employer or FAB customer service for assistance. |

|

ATM withdrawal not working? |

Verify if the ATM is connected to the Visa/MasterCard network. |

|

Forgot PIN? |

You can reset your PIN at any FAB ATM or get help by calling customer support. |

|

Card not functioning at POS? |

Ensure the POS machine accepts Visa/MasterCard. If the problem persists, contact FAB. |

|

Card blocked? |

Immediately call FAB customer support or visit a branch for assistance. |

FAQs-Frequently Asked Question

Conclusion

This article discussed how to perform a Ratibi Card Salary Check. We explained how to use the card and highlighted the various benefits of the Ratibi Card Salary Check. It’s not only useful for salary withdrawals—there are many additional advantages. The card doesn’t require a minimum balance in an account, and you can use your FAB Ratibi Card anywhere in the UAE anytime. Employees earning AED 5,000 or less per month can easily benefit from it, making it a perfect solution for low-income workers. Overall, it’s a win-win situation for employers and employees.